Key Insights for Diverse Bank Account Openings

We offer a tailored guide that demystifies the process of setting up various types of bank accounts.

Our comprehensive resource provides essential information on the prerequisites, procedures, and regulatory nuances of bank account openings in Hong Kong, China, Singapore, and other offshore locations. We aim to equip you with the knowledge to make informed decisions, ensuring that your banking experience is seamless, whether you’re expanding your business, entering new markets, or simply looking for optimal financial solutions.

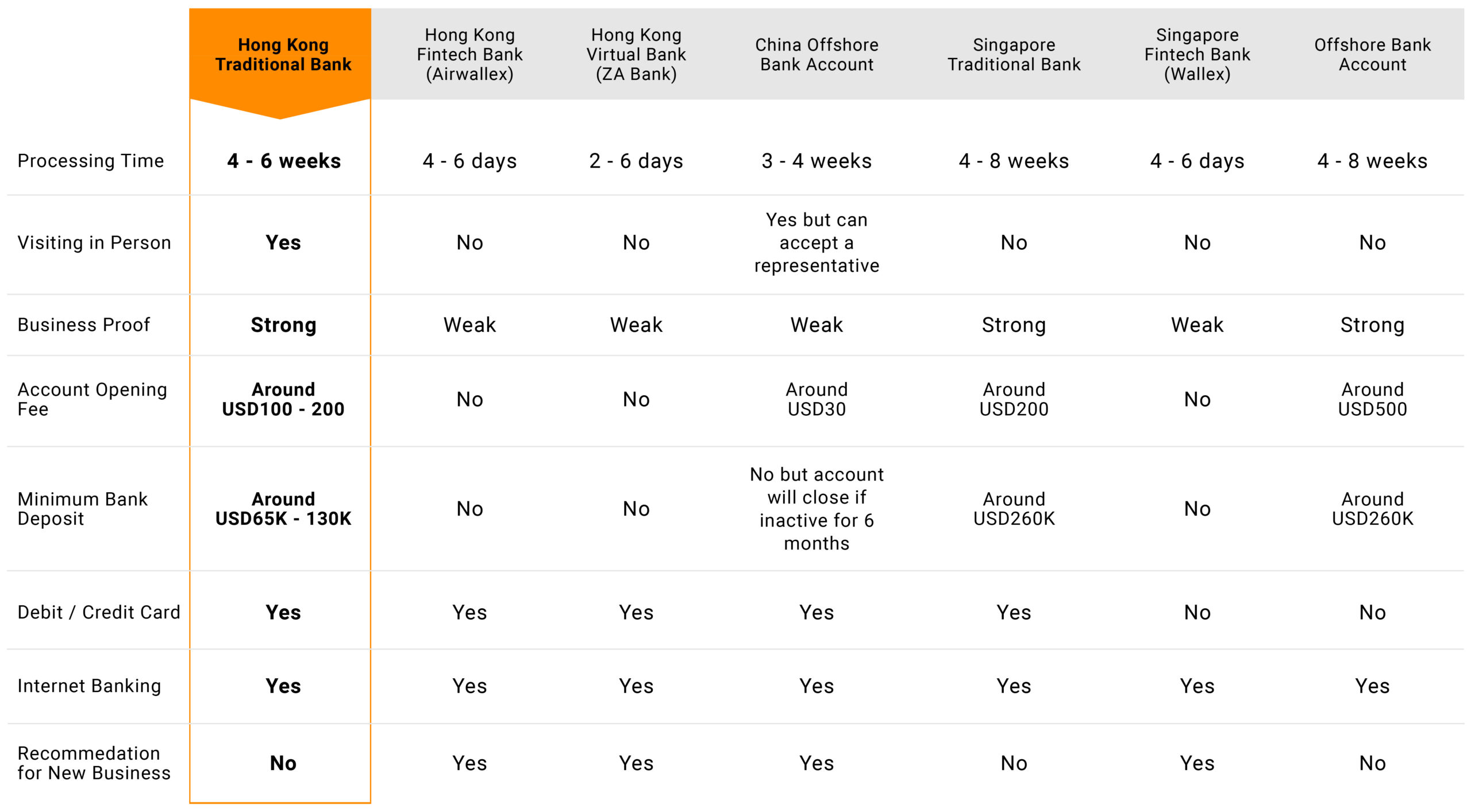

Hong Kong stands out globally as it imposes no foreign exchange controls, allowing unrestricted fund movement within its jurisdiction. However, the Hong Kong Monetary Authority mandates that banking institutions must conduct at least one in-person meeting with clients before opening an account, prohibiting the use of attorneys or proxies for this purpose. HKCore specializes in facilitating swift bank account openings in Hong Kong, typically within 1 to 5 working days.

We begin by advising clients on selecting a bank that aligns with their needs, followed by preparing necessary documentation, and scheduling meetings with bank managers. We offers comprehensive support throughout the process, ensuring efficient and expedited account setup.

Furthermore, our director (Raymond Chan) provides a pre-meeting to prepare clients for the bank appointment, offering personal accompaniment to the meeting to guarantee a smooth experience. Post-meeting, our team diligently follows up with the bank to finalize the account opening swiftly.

Given the frequent changes in banking requirements, we advise clients to consult thoroughly with their service providers or company secretaries prior to bank account initiation to avoid unnecessary expenses and wasted efforts in corporate setup.

Learn more about opening a bank account in Hong Kong.

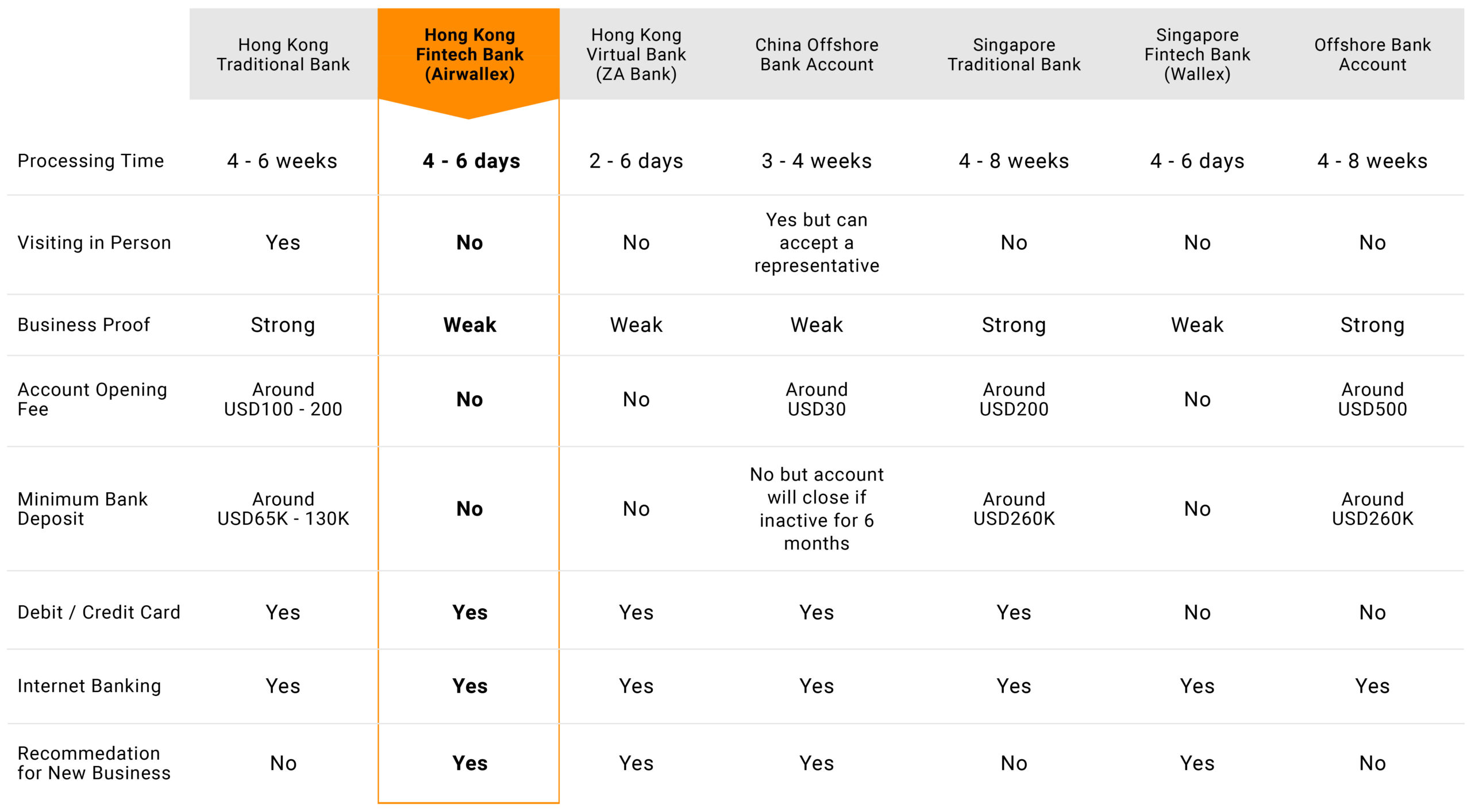

Since 2019, innovative online Fintech banking services like Airwallex and Currenxie have emerged in Hong Kong, providing digital banking solutions without traditional licenses, under the oversight of Hong Kong's regulatory authorities. Instead of operating as typical banks, they process transactions with custodian services provided by established banks like DBS (Hong Kong) and Standard Chartered Bank, Hong Kong.

CORE acts as an intermediary partner for these Fintech services, facilitating the account opening process in Hong Kong for clients, which includes handling application forms and offering guidance on setup procedures. Clients can open bank accounts remotely via video conference using platforms like Skype or WhatsApp, with a simplified verification process that requires minimal documentation. A company website can be used to showcase business activities.

Learn more about opening a Fintech / Digital Bank Account in Hong Kong.

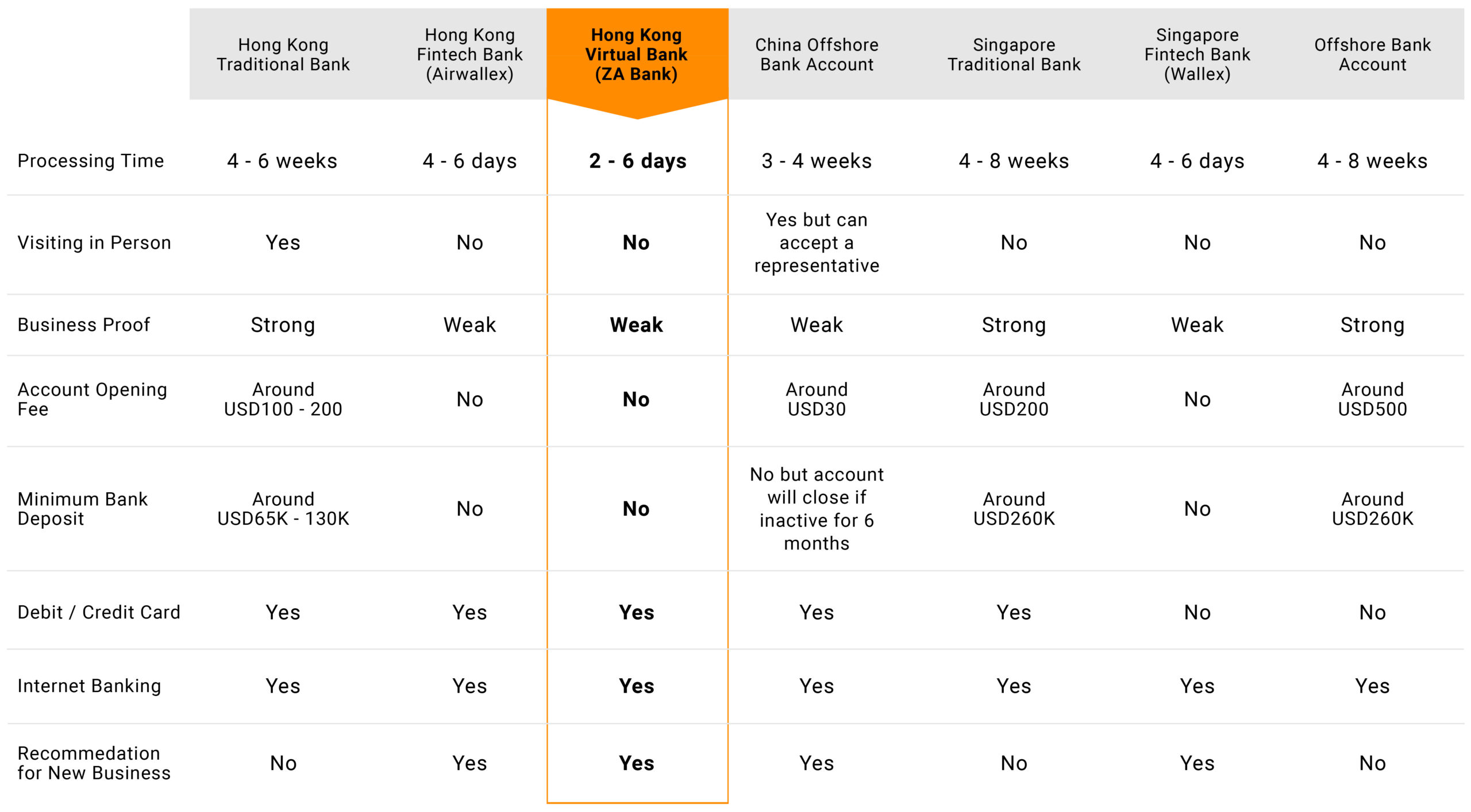

Since May 2018, the Hong Kong Monetary Authority (HKMA) has introduced virtual banking services and issued eight virtual bank licenses. Initially exclusive to holders of Hong Kong ID Cards, these services have now extended to SMEs and companies. CORE has become an intermediary partner with ZA Bank, specifically for facilitating the opening of business accounts.

Learn more about opening a Virtual Bank Account in Hong Kong.

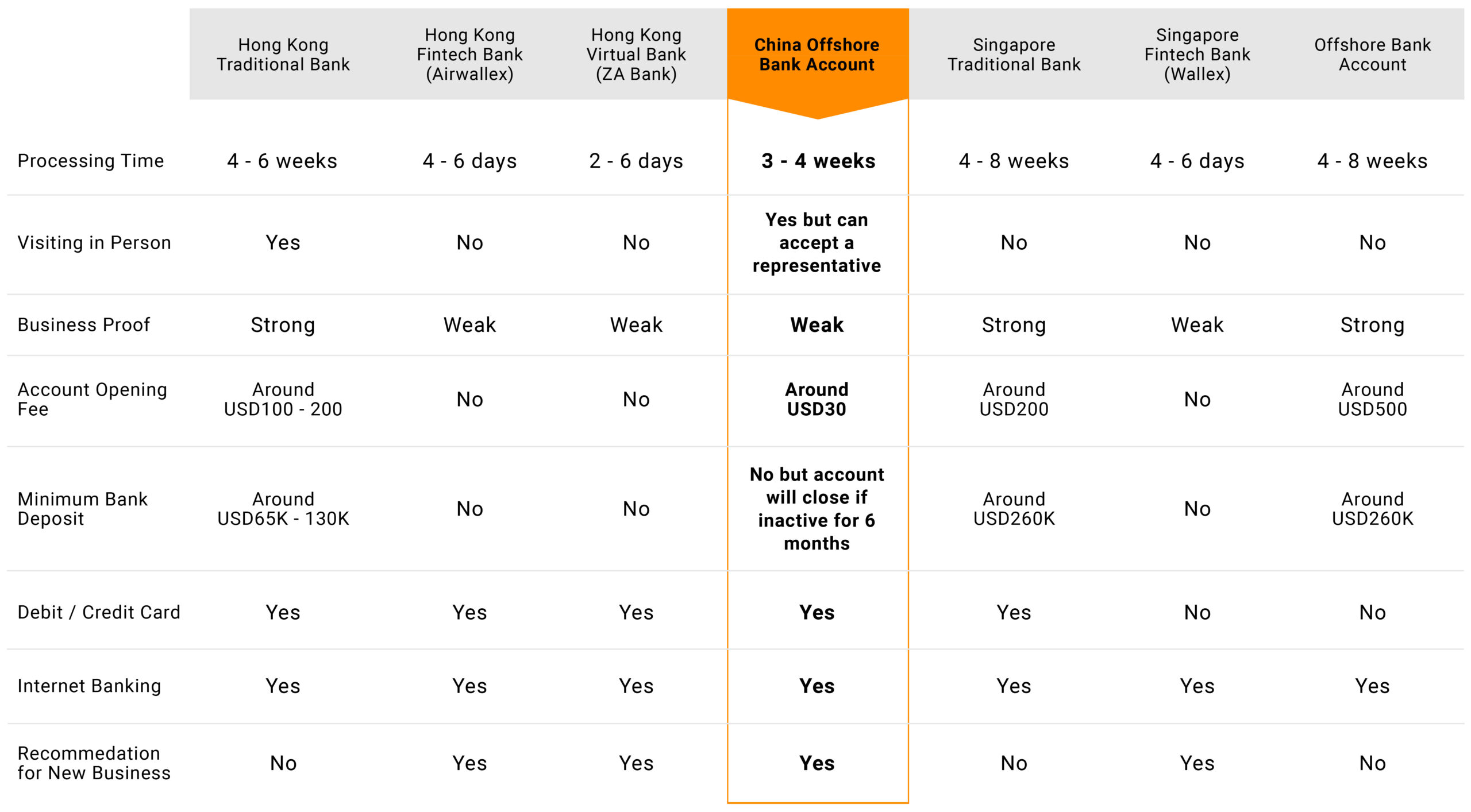

CORE offers assistance with opening Non-Resident Accounts (NRA) in Chinese banks for institutions legally incorporated and registered overseas, including those in Hong Kong or Macao, with reputable records and ongoing operations, functioning similarly to offshore bank accounts. Recently, CORE has collaborated with several licensed commercial banks to provide this service.

Learn more about opening a China Offshore Bank Account.

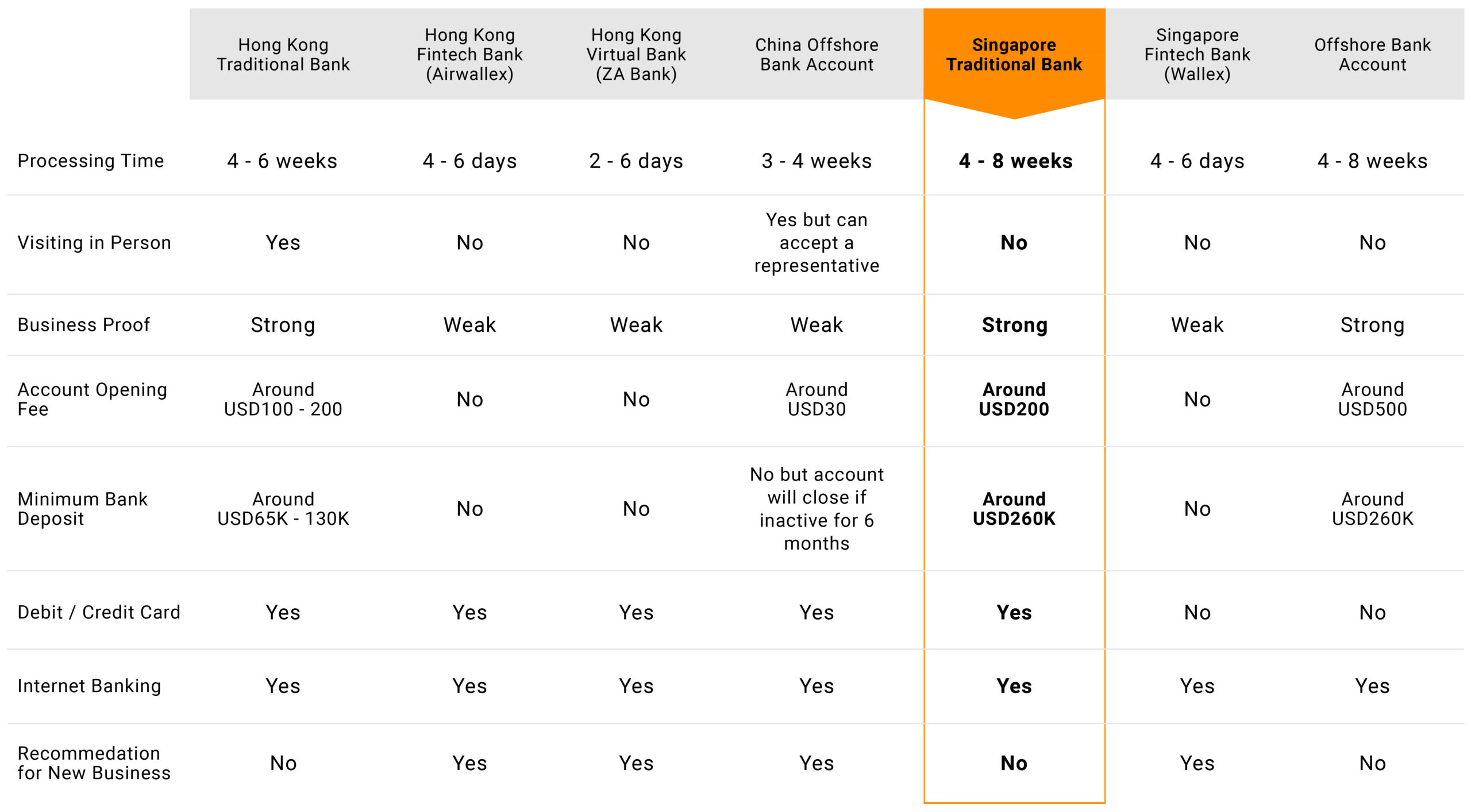

Singapore, similar to Hong Kong, operates without foreign exchange control and adheres to international standards requiring in-person meetings with all directors and bank signatories for account openings, as part of Anti-Money Laundering regulations. Attorneys or proxies cannot represent a company in these meetings.

Our services include guiding clients on choosing the right bank for their needs, preparing necessary documents, and setting up meetings with bank managers. Our staff are dedicated to providing exceptional service to streamline the account opening process.

We also offer a preparatory session with our director who will then accompany clients to ensure smooth proceedings during the bank meetings. Post-meeting, our team diligently follows up to efficiently finalize the account opening.

With frequent changes in banking regulations, we advise clients to consult carefully with their service providers before proceeding to open a bank account to avoid inefficiencies in corporate setup.

Hong Kong businesses can open bank accounts in Singapore, offering cost efficiency and stability of international banks in Singapore. This can also serve as a strategy for risk diversification. Clients interested in understanding the benefits of maintaining bank accounts across these jurisdictions are encouraged to reach out to us or relevant professional entities for more information.

Learn more about opening a bank account in Singapore.

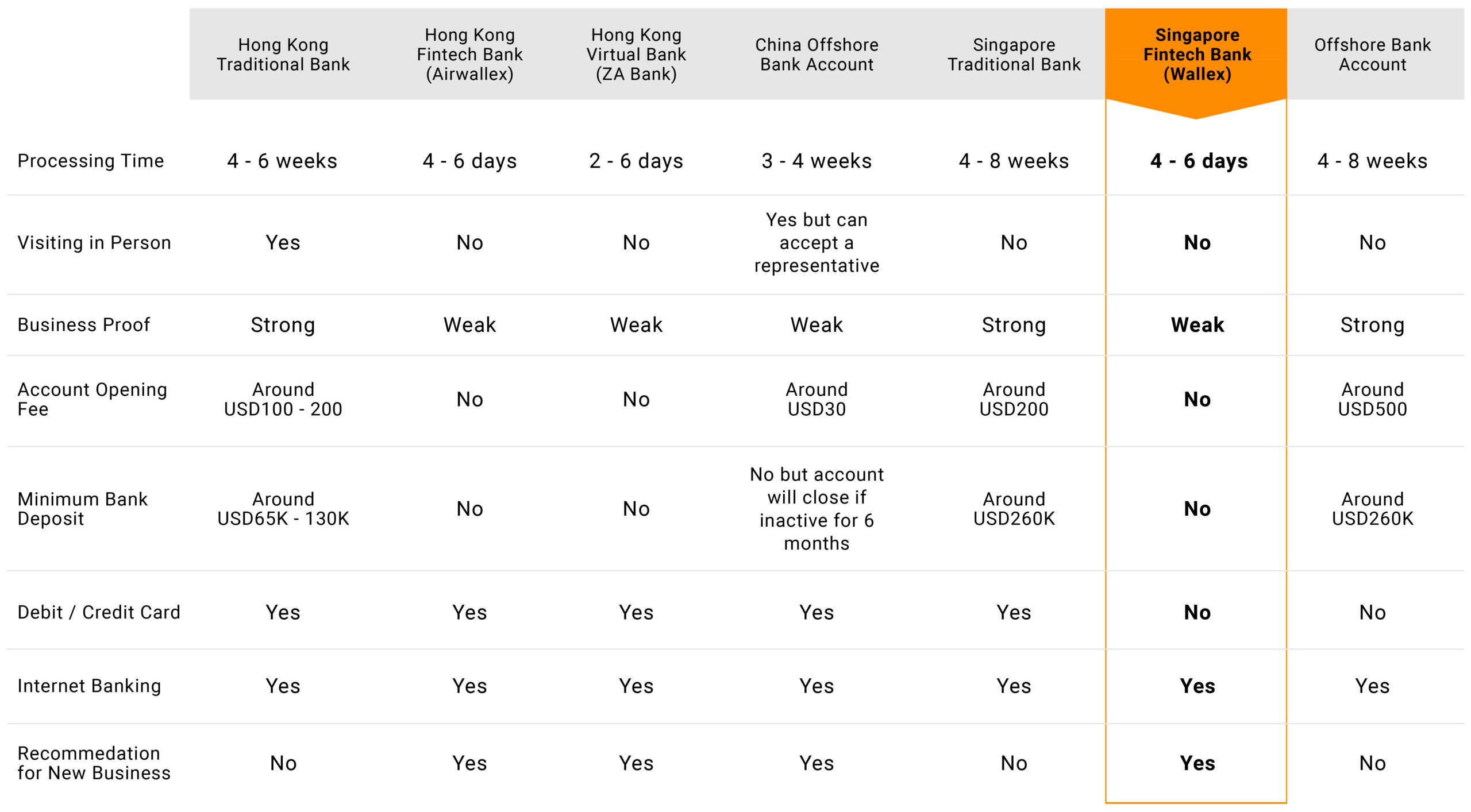

Singapore's Fintech sector includes services like Wallex, a partner specializing in remittances and foreign exchange. Wallex holds licenses not only in Singapore but also in Hong Kong and Indonesia, with DBS Bank Singapore acting as its custodian. It offers SWIFT transaction documentation (MT103) for remittances, similar to traditional Singapore banks, and provides necessary SWIFT codes and account details for fund transfers.

CORE acts as an intermediary to expedite the application and inquiry processes. We support clients through the completion of application paperwork, certification of documents, and provide guidance for a faster and easier account opening experience, streamlining the process of establishing a business bank account.

Learn more about opening a Virtual Bank Account in Singapore.

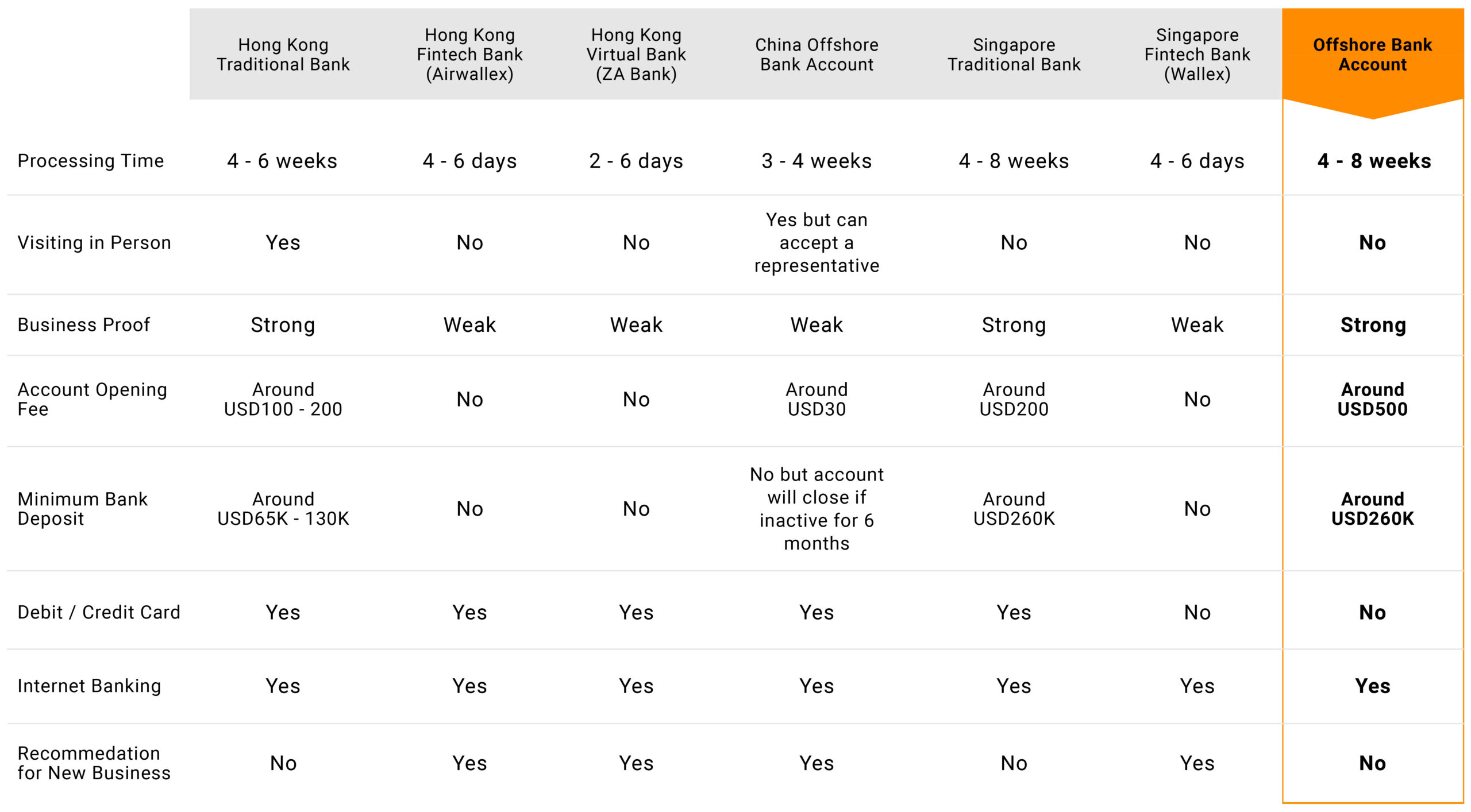

An offshore bank operates in a jurisdiction known for advantageous tax policies, higher interest rates, asset protection, and confidentiality for account holders. With hundreds of institutions offering offshore banking services, CORE maintains strict criteria and recommends a select list of reliable and reputable banks to their clients for offshore banking needs.

Learn more about opening a Offshore Bank Account in Hong Kong.