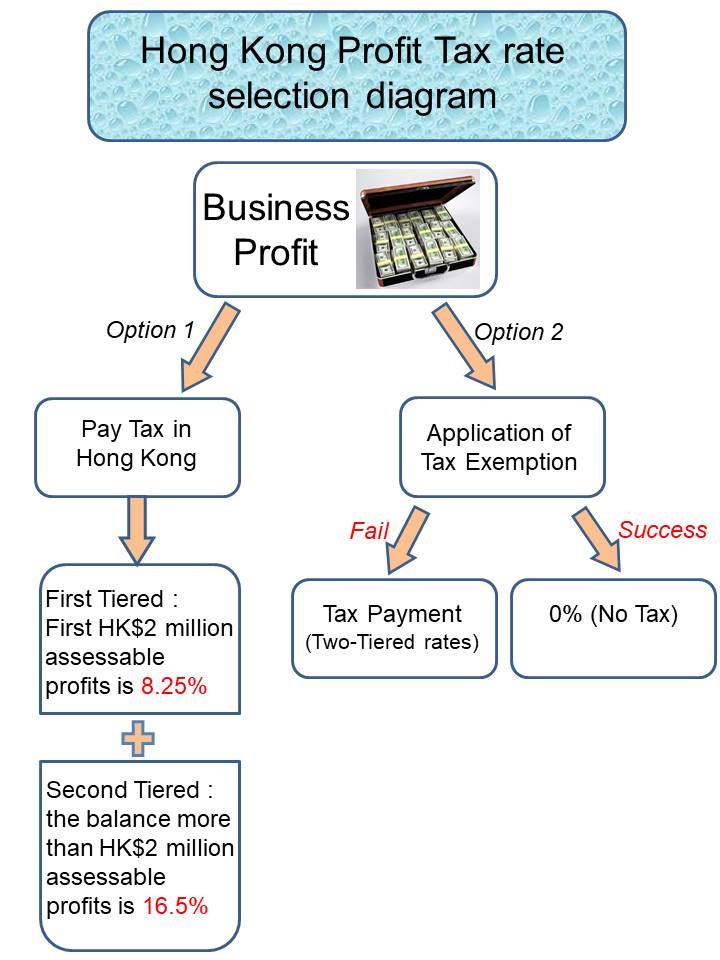

Hong Kong is one of the few countries in the world that tax on a territorial basis. Many other countries levy tax on a different basis and they tax the world-wide profits of a business, including profits derived from an offshore source. But Hong Kong profits tax is ONLY charged on profits derived from a trade, profession or business carried on in Hong Kong. Consequently, this means that a company which carries on a business in Hong Kong, but derives profits from another place, is not required to pay tax in Hong Kong on those profits. Hong Kong sourced income is currently subject to a rate of taxation of 8.75% of the first HKD2 million profits and 16.5% of the profits more than HKD2 million. There is no tax in Hong Kong on capital gains, dividends and interest earned.

The principle of Hong Kong income tax is that it is a tax on income that has its source in Hong Kong rather than a tax based on residence. Income sourced elsewhere, even remitted to Hong Kong, is not subject to Hong Kong profits tax at all. Consequently, if a Hong Kong company’s trading or business activities are based outside Hong Kong, say in Europe, no taxation will be levied. This makes Hong Kong an extremely cost- effective tax planning vehicle for trading.

The factor that determines the locality of profits from trading in goods and commodities is generally the place where the contracts for purchase and sale are effected. “Effected” does not only mean that the contracts are legally executed. It also covers the negotiation, conclusion and execution of the terms of the contracts. If a business earns commission by securing buyers for products or by securing suppliers of products required by customers, the activity which gives rise to the commission income is the arrangement of the business to be transacted between the principals. The source of the income is the place where the activities of the commission agent are performed. If such activities are performed through an office in Hong Kong, the income has a source in Hong Kong. However, there may be a corporate tax liability in the country where you ‘establish a place of business’ and control the company.

More information regarding Hong Kong profits tax can be found at http://www.ird.gov.hk/eng/paf/bus_pft_tsp.htm

Wealth Safe are among the world’s top experts in offshore banking and creative tax solutions, helping clients legally slash their tax to nearly zero. Founded by former Australian tax auditor and current offshore banking master, Warren Black, Wealth Safe has been helping high income earners keep as much of their hard earned money as possible for over a decade.

www.wealthsafe.com.au

help@wealthsafe.com.au

1300 669 336

Level 28, 140 St Georges Terrace Perth WA Australia 6000

- Hong Kong Traditional Bank Account

- Fintech / Digital Bank Account in Hong Kong

- Singapore Traditional Bank Account

- Offshore Bank Account Opening

- International Debit MasterCard

- Accounting & Auditing Services

- Virtual Office Services Hong Kong

- Business Registration Hong Kong

- Secretarial Services Hong Kong

Contact

- China Hong Kong City 33 Canton Rd, Tsim Sha Tsui

- + 852 2157 8788

- info@hkcore.com